There have been lots of discussions about the state of the housing market especially for us here in San Diego who have seen home prices rise over 20% from a year ago. In fact, much of the discussion leans towards calling this increase in home values a 2013 Housing Bubble with an economist on our local news (forgive me, I didn’t catch his name) claiming “San Diego has always been boom or bust“.

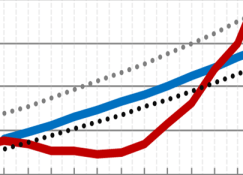

What amazes me is the shortsightedness we have. I guess in the instant gratification generation we live in, it is expected but we have to look past yesterday or last year to be able to make reasonable or educated guesses (yes, guesses. No one can fully know what will happen) on what the future holds. I’ve taken it upon myself to chart the Median Home Price for San Diego County since 1990 which was $183,210 through mid 2013 so we can have a clear picture of the ups and downs San Diego’s real estate market has experienced over the years. As a baseline I’ve included a 4% annual appreciation to further identify the swings in home values through the years.

1992 experienced a dip in home values which continued through 1995 until rebounding in 96′. The Median Home Price for San Diego County fell 8.2% in that four year period. What followed was a recovery which will set the stage for not only the infamous housing bubble that we know so well but also the economic downturn we are still trying to dig ourselves out of.

1992 experienced a dip in home values which continued through 1995 until rebounding in 96′. The Median Home Price for San Diego County fell 8.2% in that four year period. What followed was a recovery which will set the stage for not only the infamous housing bubble that we know so well but also the economic downturn we are still trying to dig ourselves out of.

This housing bubble began in 1996 with a modest 1.2% rise in the median home price but by 2006 San Diego County Median Home Prices were up 135.8% since 1996. In 2004 alone, the median home price rose nearly 30%. July 2006 saw the National Association of Realtors’ Housing Affordability Index fall to 101, it’s lowest point in history. What caused this ridiculous bubble? In my view demand. Simply put, lending standards or “creative financing” ran rampant making just about anyone with a pulse a qualified buyer with no regard for future consequences. When everybody qualifies to buy a home, you have now multiplied the demand so much, home values have nowhere to go but up. As we all know, what goes up must come down.

This housing bubble began in 1996 with a modest 1.2% rise in the median home price but by 2006 San Diego County Median Home Prices were up 135.8% since 1996. In 2004 alone, the median home price rose nearly 30%. July 2006 saw the National Association of Realtors’ Housing Affordability Index fall to 101, it’s lowest point in history. What caused this ridiculous bubble? In my view demand. Simply put, lending standards or “creative financing” ran rampant making just about anyone with a pulse a qualified buyer with no regard for future consequences. When everybody qualifies to buy a home, you have now multiplied the demand so much, home values have nowhere to go but up. As we all know, what goes up must come down.

The bigger they are, the harder they fall and this bubble was no exception. 2008 saw nearly a 35% decline bringing the housing market all but to a screeching stop.

The bigger they are, the harder they fall and this bubble was no exception. 2008 saw nearly a 35% decline bringing the housing market all but to a screeching stop.

Tax credits in 2008-2010 helped curve the downfall and allowed for a faster than normal rebound. Fast forward to early 2013, as foreclosures and short sales decreased significantly, a lack of available homes for sale caused home values to spike to our current levels. Where we should be.

The Bottom Line

If you step back and look at the historic picture, the current housing market appears more or less on track based on a 4% annual appreciation (blue line). Most had grown accustomed to lower than normal home values and are now caught by surprise calling this a bubble when in my opinion they final are where they should be.

Check back next week for what I believe San Deigo home prices will do through the Holiday season and why early 2014 may be your best time to buy.

THE REAL ESTATE BUSINESS HAS LESS TO DO ABOUT SELLING PROPERTIES AND EVERYTHING TO DO ABOUT HELPING PEOPLE.

THE REAL ESTATE BUSINESS HAS LESS TO DO ABOUT SELLING PROPERTIES AND EVERYTHING TO DO ABOUT HELPING PEOPLE.